On January 7, 2025, a Ministerial Decree was published to adjust the income tax table in accordance with the State Ordinance Personal Income Tax. This change is meant to improve purchasing power in 2025 and provide financial relief to tax payers.

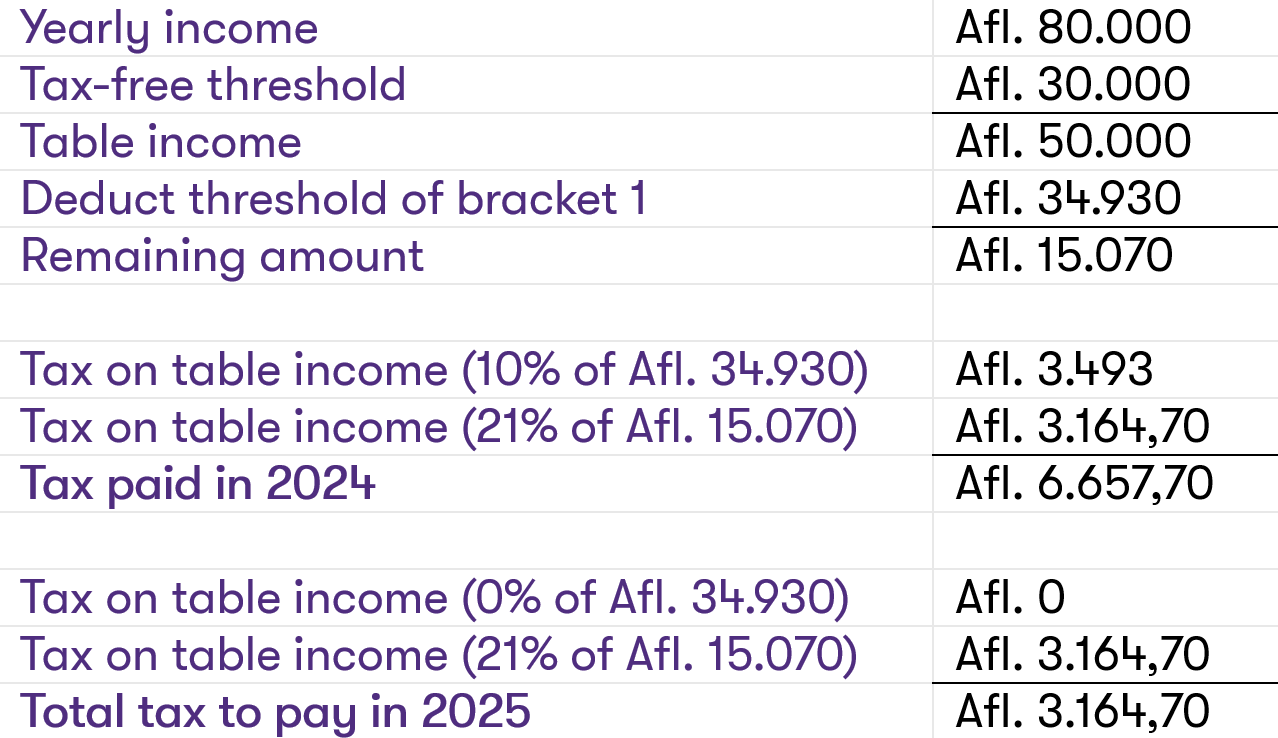

The personal income tax system is a progressive tax system. Currently, the first tax bracket for tax payers earning up to Afl. 34,930 is taxed at a rate of 10%.

As of January 1, 2025, the first bracket of the income tax table rate is reduced from 10% to 0%. However, considering there is a tax-free threshold of Afl. 30,000, this change affects tax payers with an income of up to Afl. 64,930, meaning that tax payers earning up to Afl. 64,930 will no longer pay any personal income tax. Wage tax will also not be withheld from tax payers earning less than this amount.

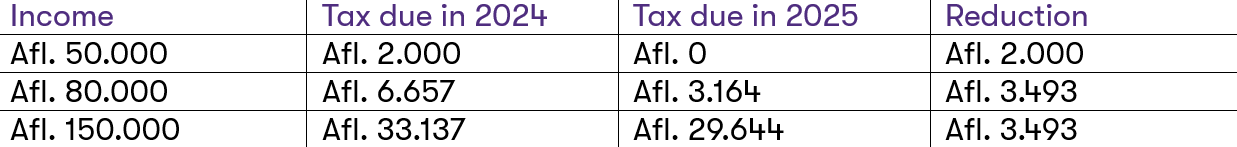

The tax rates for higher-income categories will remain the same, but due to our progressive income tax system, the reduction from 10% to 0% in the first bracket will still affect the personal income tax due by tax payers who earn income taxed in the higher tax brackets. The effect of the above mentioned change will be illustrated with below examples.

Below table reflects the savings for different income categories as a result of the change.