Introduction

In the world of financial integrity and compliance, the term "Politically Exposed Persons" (PEPs) holds significant importance. This article delves into the definition of PEPs, the types of PEPs, and the enhanced due diligence measures that must be taken when dealing with them. Understanding the risk profile of PEPs is crucial for businesses to maintain financial transparency and security.

Understanding the Risk Profile

Politically Exposed Persons encompass a diverse spectrum of individuals, ranging from heads of state and government officials to senior executives of state-owned enterprises. Their access to political power and influence places them in a unique position to shape policies, allocate resources, and engage in international transactions. However, this power also renders them attractive targets for engaging in money laundering, terrorist financing, and proliferation financing. PEPs can abuse their authority to facilitate financial misconduct, allowing ill-gotten gains to enter the legitimate financial system.

Aruban Legislation

Pursuant to Article 12, paragraph 1, of the AML/CFT State Ordinance, a service provider must pursue an adequate policy and have risk-oriented procedures in place to determine whether a customer, a potential customer, or an Ultimate Beneficial Owner (UBO) is a Politically Exposed Person (hereafter: PEP). In this newsletter, we will provide you with insights into who is considered a PEP.

Definition PEP

A Politically Exposed Person is defined by the Financial Action Task Force (FATF) as an individual who is or has been entrusted with a prominent political function.

The person(s) who is/are or has/have been charged with the following prominent political functions are considered PEPs:

- heads of state, heads of government, ministers, and state secretaries;

- members of parliament;

- members of the governing bodies of political parties;

- members of supreme courts, constitutional courts, and other high tribunals that render judgments that generally are not open to appeal;

- members of courts of auditors and of the board of directors of central banks;

- ambassadors and chargés d'affaires;

- high-ranked army officers;

- members of executive, management, or Supervisory bodies of state-owned companies;

- directors, deputy directors, and members of the board or equivalent function of an international organization.

Type of PEPs

A service provider should determine the type of PEP once identified. There are three types of PEP:

- Foreign PEPs: natural persons who are or have been entrusted with prominent public functions by a foreign country.

- Domestic PEPs: natural persons who are or have been entrusted domestically with prominent public functions.

- International organization PEPs: natural persons who are or have been entrusted with a prominent function by an international organization, refers to members of senior management or natural persons who have been entrusted with equivalent functions, i.e., directors, deputy directors, and members of the board or equivalent functions.

Who is considered a PEP?

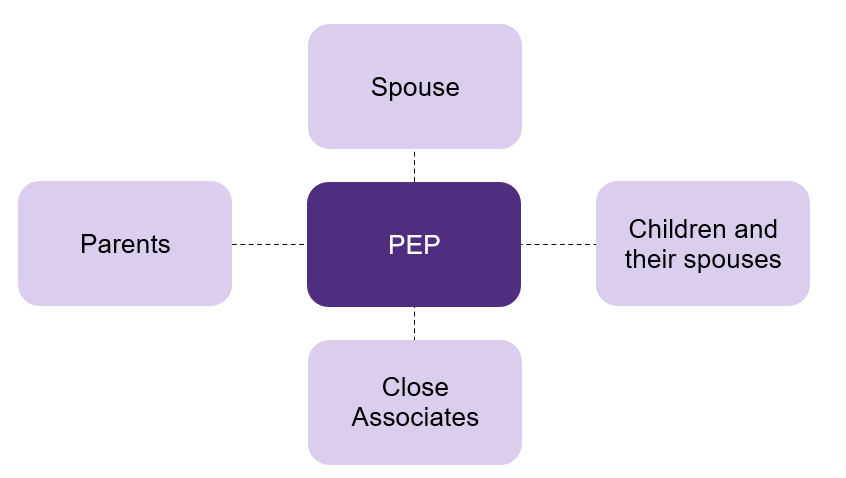

Direct family members and close associates of the persons who are or have been charged with the listed prominent political function as PEPs are also considered a PEP.

Family members include the following:

- The spouse, or a person considered to be equivalent to a spouse, of a PEP.

- The children and their spouses, or persons considered to be equivalent to a spouse, of a PEP.

- The parents of a PEP.

Close associates are natural persons who are closely connected to a PEP, either socially or professionally:

- Natural persons who are known to have joint beneficial ownership of legal entities or legal arrangements, or any other close business relations, with a PEP.

- Natural persons who have sole beneficial ownership of a legal entity or legal arrangement which is known to have been set up for the de facto benefit of a PEP.

Enhanced Due Diligence

PEPs represent a higher risk for financial institutions and designated non-financial institutions because they are more likely to become involved in financial crimes like money laundering, the financing of terrorism, or proliferation financing than other clients. Therefore, PEPs should always be subject to Enhanced Due Diligence (hereafter: EDD) measures. If the client as a natural or UBO becomes or proves to become a PEP during the course of the business relationship, the service provider shall take the EDD measures as quickly as possible. When a PEP is identified, the client is always considered high risk.

Source of Funds and Source of Wealth

For all PEPs, the source of funds and source of wealth need to be established using reasonable measures. Based on these measures, the service provider assesses if the sources are from a legitimate origin. An analysis of the PEP’s source of funds and wealth is necessary for assessing and mitigating the risk of getting involved in (possible) money laundering, terrorism financing, and/or proliferation financing.

Duration PEP

A natural person will be considered a PEP till 5 years after he or she leaves the prominent political function(s). This is also applicable to their family members and close associates.

Conclusion

In summary, the presence of Politically Exposed Persons in the financial landscape poses a distinctive challenge. Their roles grant them access to resources and influence, making them attractive targets for financial misconduct, including money laundering, terrorist financing, and proliferation financing. Aruban legislation, in alignment with international standards, defines PEPs and requires Enhanced Due Diligence measures for them. This comprehensive approach, which includes scrutinizing the source of funds and wealth, aims to safeguard the integrity of the financial system and ensure transparency and security. Recognizing and managing the risks associated with PEPs is crucial in maintaining the integrity and trustworthiness of the financial sector.

![[EN] Politically Exposed Persons](/dist/images/pdf-covers/horizontal.svg)